Some people kill time at the airport by browsing duty-free shops. I decided to shop for bitcoin.

But first, there are two things you should know about me: I tend to be almost as afraid of losing money investing as I am of flying. On some level, I figured one fear might cancel out the other.

So last Thursday, while waiting for a flight to Nashville, I pulled up a popular application called Coinbase that can be used to buy and sell bitcoin. The virtual currency had hit $10,000 for the first time a couple days earlier, before retreating somewhat. News of bitcoin's rapid rise was everywhere, including on CNN.

You must have a balance of at least 0.0001 bitcoin to make a withdrawal. You can withdraw up to $2,000 worth of bitcoin every 24 hours and up to $5,000 within any 7-day period. Transfers to external wallets usually take between 30–40 minutes but can take longer. To view your bitcoin limits and progress: Tap on the Banking tab; Tap Bitcoin. Now a days bitcoin to bank account is suitable option for all the people who want to cash out bitcoin through exchanges. You can make transactions anonymously with us. Our website offers different bank option you can choose your desired bank to withdraw bitcoin to a particular bank account. On this website, you can sell Bitcoins in two ways- through online bank transaction. If you like a more extensive overview on cashing out bitcoin, check out our blog post on How do I transfer Bitcoin to my bank account. So, cashing out bitcoin is not difficult at all. Now that you can answer “ how do you cash out a bitcoin”, why not get to practice?

For 15 minutes at the airport, I refreshed the price of bitcoin over and over, watching as it gained and lost hundreds of dollars in a matter of minutes. I called out the price fluctuations breathlessly to my wife, who gently encouraged me not to be an idiot, before returning to her magazine.

She was in good company. JPMorgan Chase CEO Jamie Dimon recently called bitcoin a 'fraud' and suggested people who buy it are 'stupid.' Warren Buffett called bitcoin a 'mirage' in 2014 and warned investors to 'stay away.'

Are you trading Bitcoin? We want to hear from you.

And yet bitcoin has climbed more than tenfold since Buffett's warning. Earlier this month, one college friend casually told me over drinks he'd made tens of thousands of dollars investing in another cryptocurrency. He said he hoped it would be worth enough one day to buy a house.

When I saw the price of bitcoin fall to $9,500, I pressed buy, defying the wisdom of two finance titans and my wife. One hundred dollars, or 0.0101 bitcoins. (A few days later, I bought another $150.) By the time we got to our hotel, my stake had already gone up 10%. One week later, it was (briefly) up 100%. My wife's opinion of me has reportedly decreased by the same amount.

What is happening?

It's an investing frenzy, plain and simple.

Bitcoin cracked $1,000 on the first day of 2017. By this week, it was up to $12,000, and then it really took off: The price topped $17,000 on some exchanges Thursday, and $18,000 on at least one.Other cryptocurrencies have seen similar spikes, though they trade for much less than bitcoin.

There's a long list of factors people may point to in an attempt to explain this. Regulators have taken a hands-off approach to bitcoin in certain markets. Dozens of new hedge funds have launched this year to trade cryptocurrencies like bitcoin. The Nasdaq and Chicago Mercantile Exchange plan to let investors trade bitcoin futures, which may attract more professional investors.

Yet a key reason the price of bitcoin keeps going up is, well, because it keeps going up. Small investors like yours truly have a fear of missing out on a chance to get rich quick. And when the value of your bitcoin doubles in a week, as it did for me, it's easy to think you're a genius. But you can get burned assuming it will keep skyrocketing.

Some investors have likened the bitcoin hype to the dot-com bubble. Others, like Dimon, have said it's even 'worse' than the Dutch tulip mania from the 1600s, considered one of the most famous bubbles ever.

As Buffettput it back in 2014, 'the idea that [bitcoin] has some huge intrinsic value is just a joke in my view.' Bitcoin is not backed by a company's earnings, or the strength of a government and rule of law. There's also no interest or dividends.

Why would anyone want or need to use bitcoin?

Bitcoin serves as a new kind of currency for the digital era. It works across international borders and doesn't need to be backed by banks or governments.

Or at least that was the promise when it was created in 2009. The surge and volatility of bitcoin this year may be great for those who invested early, but it undermines bitcoin's viability as a currency.

Right now, I can use my bitcoin holdings to pay for purchases at Overstock(OSTBP), or book a hotel on Expedia(EXPE). But if I use bitcoin to buy $25 worth of socks on Overstock today, and the price of bitcoin quadruples next week, I'll feel like those socks actually cost me $100. Then again, if bitcoin crashes, at least I'll always have the socks.

Rather than a currency, bitcoin is being treated more like an asset, with the hope of reaping great returns in the future.

So is there anything truly valuable about bitcoin?

Yes, the technology behind it.

Bitcoin is built on the blockchain, a public ledger containing all the transaction data from anyone who uses bitcoin. Transactions are added to 'blocks' or the links of code that make up the chain, and each transaction must be recorded on a block.

Even bitcoin critics like Dimon have said they support the use of blockchain technology for tracking payments.

Is there a legal and legitimate way to invest in bitcoin?

Bitcoin exchanges have a checkered history. Mt.Gox, once the largest exchange, shut down in 2014 after losing hundreds of millions of dollars worth of bitcoin after a hack.

Today, the leading exchange is offered by Coinbase, a startup that has raised more than $200 million from a number of top tier venture capital firms. Square(SQ), the payments service, is also rolling out a bitcoin product.

There are also bitcoin ATMs in scattered bodegas and convenience stores around the country, through companies like Coinsource. The ATMs let you exchange bitcoin for cash, or vice versa by scanning a QR code from the digital wallet application on your phone.

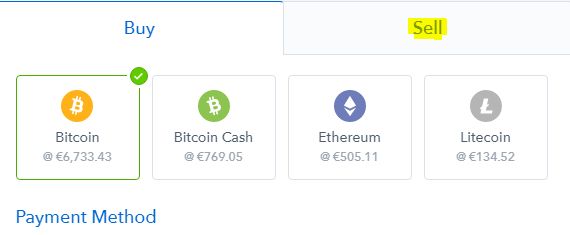

With Coinbase, you must first give the app permission to connect to your bank account. As with other stock trading applications, you pay a small fee for each transaction, buying and selling. But the transaction can take significantly longer.

My original $100 bitcoin purchase won't officially be completed on Coinbase until Friday, more than a week after the transaction. The price I bought it at remains the same, but I won't be able to sell at the earliest until Friday.

If the price plummets before then, I'm out of luck. No socks for me.

-- CNN's Selena Larson contributed to this report.

Article Contents:

Everyone dreams of what it would have been like to invest early in Bitcoin. They would be rich now. They could exchange their Bitcoin into fiat money and buy whatever they desire and live a free live.

For some this has pretty much become reality. But before you actually hold the money in your hands, there is the barrier of the ideal cash out. Where and how to perform the exchange – What’s the best way to get money for your Bitcoin asset?

The exchange from Bitcoin into fiat money is a topic you should know something about before you actually perform it. Because depending on from which country you come or in which form you exactly want to pay out, there are details to consider. Otherwise you risk to lose a sizable part of your asset in the form of taxes, for instance.

Known and trusted Exchanges for Bitcoin into Fiat Money:

Currencies:

Withdrawal Methods

Bank Transfers

Particularities:

Fees:

Currencies:

Withdrawal Methods

Bank Transfers

Particularities:

for cash out) can

take long timebad customer support

Fees:

USD withdrawal:

$50

(or 1% for cash outs

above $5000)

Currencies:

Withdrawal Methods

- bank transfer

- Credit Card

- AdvCash

- Payeer

- Perfect Money

- Qiwi

- ElecsNet

- EX-Code

- Yandex

Bank Transfers

Particularities:

Fees:

- USD:

- 0% CryptoCapital

- 0.2% EX-CODE

- 1.45% AdvCAsh

- 0.5% Payeer

- EUR:

- SEPA: €50

- 0% CryptoCapital

- 0.2% EX-CODE

- RUB:

- Varying Fees

Currencies:

Withdrawal Methods

How To Cash In Bitcoin

- Bank transfer,

- Credit Card

- Debit Card

- EPS

- Giropay

- Neteller

- Skrill

- iDeal

- Zimpler

Bank Transfers

Particularities:

for EU residents

within the SEPA,

plus Iceland,

Liechtenstein,

Norway, Switzerland

and Monaco

Min €25

Fees:

Currencies:

Withdrawal Methods

Bank Transfers

Particularities:

(outside USA)

require Etana Custody

service sign upHigh limit cash out

for US customers

for $5 fee possible

Fees:

5 USD/EURWorldwide:

35 USD/EUR +0.125%

Currencies:

Withdrawal Methods

Bank Transfers

Particularities:

Fees:

Currencies:

Withdrawal Methods:

Bank Transfers:

Particularities:

Fees:

Sell Bitcoin Tax Free

The country you come from plays a big role when it comes to deciding how best to cash out Bitcoin, especially if you want to pay out larger amounts. If you live in Germany, then the payment is tax-free if you sell Bitcoin more than one year after purchase.

If you buy Bitcoin and sell it within one year, taxes will be due, in full according to the personal progressive tax rate (income tax). So the capital gains tax does not apply – contrary to what many people suspect. Depending on the amount paid out, it can therefore happen that the maximum income tax rate applies: about 43%.

In the USA for instance, selling Bitcoin always triggers a taxable event, no matter how much time there was between the purchase and the sale. However, time matters when it comes to the amount of taxes you have to pay:

If less than 1 year has passed since you bought Bitcoin, you have to pay short-term capital gain taxes on the disposal. If more than 1 year has passed, long-term capital gain taxes are due. In both cases the tax can be quite substantial and those affected likely wonder if there might be a way around these levies.

Bitcoin Taxes in the USA:

Short-term capital gains tax: falls into income tax, like additional income, so is subject to the individual income tax rate

Long-term capital gains tax: Depending on income class, 0 – 20%.

How To Get Cash for your Bitcoin without paying Taxes?

If you sell Bitcoin on a cryptocurrency exchange and then have the money paid out, this is always a taxable event (e.g. USA, Germany, others). Whether by bank transfer, credit card or Paypal, there is a transaction that is visible and on which taxes may be due. Thus, the way over an exchange, from which you get money paid out, is probably not what you seek.

Cash out Bitcoin anonymously?

The first way to get cash for Bitcoin, and avoid taxes, would be a private exchange off the books. All you have to do is find someone who can bring enough cash and is willing to do it without KYC / ID. But in many countries this is of course a form of tax evasion and not advisable. Besides, the biggest challenge would be to find someone like that.

The peer-to-peer exchange platform localbitcoins.com is a place where you can exchange BTC into cash in principle, but without an ID-verified account (i.e. anonymously) this is only possible with relatively small sums.

Leave your Country and cash out Bitcoin abroad

One option is to leave your country permanently and cash out your Bitcoin in another country afterwards. If Bitcoin has made you rich, this can be a realistic option. In principle, it’s possible to live as a nomad without fixed residency, as an earth resident so to say.

In this case of a state-independent existence you wouldn’t be taxed anywhere. Provided you’re never too long in one place. In each country there is a certain period of residence from when you become taxable. Normally there is a tax liability starting from half a year residency. Therefore, 3 different locations per year would already be sufficient if you’d spread the time equally, in case you’re not too much into traveling.. 4 months maximum at a place should be save.

The situation is different for US Americans: they have to give up their US passport in order to lose their tax liability. Tax liability in the USA is linked to citizenship. Citizenship means passport.

Today, however, there are simple methods to get another quality passport. Especially if you have money. So you can buy citizenship in places like Grenada, Antigua & Barbuda, Dominica, St. Kitts and Nevis or even Russia. Surely there are others. Depending on the sums involved, living nomadic could be an interesting solution, at least for some time.

How to cash out a bigger amount of BTC without making major mistakes you might regret later?

Cash for Bitcoin – Here’s perhaps the Smartest Option:

A much more tricky solution to get cash against Bitcoin are Bitcoin Loans. This means that you would take out a loan with a financial service provider for which you deposit Bitcoin as a pledge.

So you get a certain amount of money against Bitcoin, and you don’t have to pay tax on this money, because it is a loan. Your BTC only move temporarily from your custody to the custody of the loan company, and in the end you get it back.

A Bitcoin loan in a bull market is particularly advantageous if the BTC price at the end of the loan is significantly higher than at the beginning of the loan. Then one would have the possibility of refinancing the first loan with a smaller amount of BTC. In a bull market, you may already be able to get a portion of your BTC back during the loan term, depending on how far the price would have risen.

Find out more about Bitcoin backed Loans.

Sell Bitcoin for Cash

If you are sure that the loan path is not the right one for you, and you definitely want to convert Bitcoin to USD or whatever fiat currency, the following questions arise.

Are you sure you want to pay out a large amount of Bitcoin at once?

Maybe one part will do now and the rest can follow later? For example, it would be possible to calculate how much Bitcoin you can cash out per year without paying taxes, or just a small amount. The sticking point here would be to avoid the 20% tax. If you pay out a fortune of millions at once, however, a corresponding levy will certainly be unavoidable (except for BTC loans!). This whole consideration of course only makes sense if you’re bullish on Bitcoin. If you don’t think that Bitcoin will go further up long term, then there’s no question why you would want to sell all at once.

Sell Bitcoin for USD and withdraw the Money to your Bank Account

If the sale on a cryptocurrency exchange should come into question, you can use a big bitcoin exchange allowing fiat money withdrawals. The biggest and most trusted ones are in the comparison table at the beginning of this page.

Depending on the trading amount and income class, a taxable event can occur at the time of the sale on an exchange. Whether this is the case and how much it is, should therefore be calculated IN ADVANCE in order not to be surprised by a tax payment you may not be able to pay. In particular, if you want to cash out the Bitcoin to invest the money immediately into another project, the necessary cash flow may be missing as soon as the tax payment is required.

This is exactly the problem many people had in 2018, after they had sold BTC at a high rate in late 2017. The money they had received for selling their BTC was no longer available when the tax was due. And their other savings weren’t sufficient. This is a problem you should urgently avoid.

This is where the Bitcoin Loans come into their own again, as a solution to this problem, since you don’t need to pay taxes on borrowed money / debt.

Can You Cash Out Bitcoin Stock

Cash Out Bitcoin on the Street

ATM Withdrawals

Can You Cash Out Bitcoin On Cash App

There are generally 2 different ways to withdraw Fiat money from an ATM against Bitcoin. The first is to use one of the few Bitcoin ATM that already exist at some places. If you’re lucky one might be nearby to your place. The other way is to use a normal ATM with a Bitcoin debit card. There are several Bitcoin card providers – actually there are a lot, but the majority are scammers, so you need to make sure you take one of the good ones.

1. ATM Withdrawal with Bitcoin Debit Cards

To our knowledge, the following card providers are reputable and no scams. However, we recommend do your own research about them.

2. BITCOIN ATM Withdrawal

Since couple of years there are special Bitcoin ATMs where you can exchange money for Bitcoin or vice versa on the street. In New York City there are already about 150 Bitcoin ATMs right now. Money can be deposited into these machines to buy Bitcoins. Occasionally it is also possible to sell Bitcoins at these ATMs to cash out money.

On the coinatmradar.com site you can find current Bitcoin ATM locations. In addition the map shows at which ATMs you can only buy BTC and which machines also offer fiat money cash outs against Bitcoin. But it is noticeable: There are a total of 4,726 Bitcoin machines in 77 countries (May 2019).

We do not recommend to use such machines to buy Bitcoins. This is sometimes much easier and better via crypto exchanges. In addition, you would have to bring a lot of cash with you to the machine. That shouldn’t be worth it. Also, you hardly have an overview of whether you are currently buying at a good or a bad price. Also the fees are not yet foreseeable.

Can You Cash Out Bitcoin On Robinhood

To withdraw money, by selling Bitcoins and getting paid Fiat money, the machines are probably be more suitable. They simply offer another way to withdraw money. Little seems to speak against that, a weak point is, however, that you can’t see in the ATM whether you’re about to sell for a good price or not. Many people certainly know a similar problem from abroad when withdrawing a foreign currency. So Bitcoin machines are quite nice, but in the future they would have to develop further and offer more functions and low fees in order to actually assert themselves.

Sell Bitcoin – No Cash Out

What if you sell Bitcoin but don’t cash it out (so you won’t send the money to your bank account) ?

The moment you exchange Bitcoin for a Fiat currency, a taxable event occurs. Even if you don’t have the money paid out to your bank account. In principle, at this point, you own the money, whether it is on the exchange or on your bank account is a detail that really doesn’t matter. So you have to be aware that you always have to pay taxes on the sale. The event will also not be undone if you reinvest the entire amount immediately. However, before the next tax return, all individual trades are offset against each other (profits against losses), and the final amount is entered into the tax declaration.

That’s why you have to keep an exact record of all individual Bitcoin trades. But this is usually no problem, since this data should be stored in the Trading History of your exchange platform or broker.